Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Introduction

Welcome to a comprehensive guide on easily transferring money between Facebook Pay and Cash App. In a time where advanced exchanges are overcome, connecting these two well-known stages can offer unmatched accommodation.

This article will walk you through the arrangement cycle, guide you on moving assets easily, and give important experiences into likely advantages and disadvantages. Whether you’re a carefully prepared client or new to distributed installments, this guide guarantees a smooth excursion from starting exchanges to investigating issues.

Let’s jump into the universe of easy cash moves and open the maximum capacity of the Facebook Pay and Cash App to Money application.

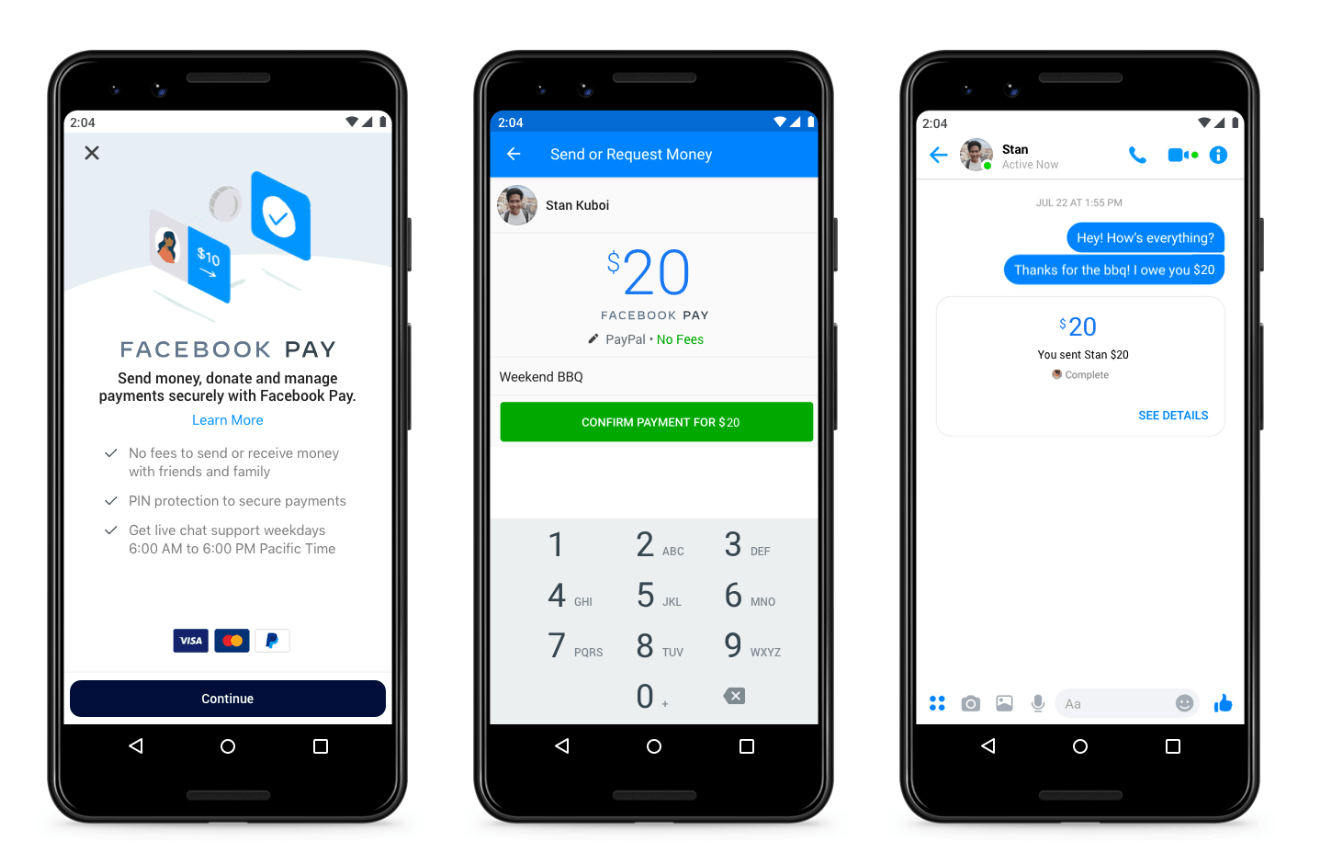

Facebook Pay is the most common way of sending and getting cash inside the Facebook biological system. To get everything rolling, follow these steps:

1. Navigate to Facebook Pay: Open your Facebook application and go to the Settings menu Look for “Facebook Pay” or a similar option.

2. Initiate Setup: Follow the on-screen instructions to set up your Facebook Pay account. You may need to enter your payment details and personal information.

3. Review and Confirm: Carefully review the information you’ve entered and confirm your setup. This step ensures the accuracy of your linked payment methods.

Connecting your financial balance to Facebook Pay is critical for consistent exchanges. This is the way you can make it happen:

1. Access Facebook Pay Settings: Go back to the Facebook Pay section in your app’s Settings.

2. Add Payment Method: Search for the choice to add an installment strategy and pick “Financial balance.”

3. Enter Bank Details: Info your financial balance subtleties, including the record and direct numbers.

4. Verification Process: Facebook may conduct a verification process to ensure the authenticity of the linked bank account. This could involve a small test deposit that you’ll need to confirm.

Now that your Facebook Pay is set up, how about we associate it with your Money Application for consistent cash moves:

1. Download Money Application: On the off chance that you haven’t as of now, download and introduce the Money Application on your cell phone.

2. Connect Charge Card: Open the Money Application and connect your check card to your record. This is usually done during the initial setup process.

3. Enable Direct Deposit (Optional): While not mandatory, enabling direct deposit in the Cash App can provide added functionality for receiving funds.

4. Link Cash App in Facebook Pay Settings: Return to Facebook Pay settings and look for the option to link external accounts. Choose Cash App and follow the prompts to establish the connection.

By finishing these means, you’ve effectively set up and associated your Facebook Pay and Money Application accounts. This establishes the groundwork for smooth and secure cash moves between the two stages. In the following segments, we’ll investigate how to add reserves, start moves, and address any potential difficulties that might occur.

When your Facebook Pay account is set up and associated with your Money Application, the subsequent stage is to add assets to work with consistent exchanges. Here is a step-by-step guide:

By following these means, you’ll have effectively financed your Facebook Pay balance, making a pool of assets that can be handily used for different exchanges inside the Facebook biological system.

Note: It’s fundamental to keep an adequate equilibrium in your Facebook Pay record to start moves to Money Application.

In the following segment, we’ll investigate the different techniques and steps engaged in moving cash from your Facebook Pay equilibrium to your Money Application account, guaranteeing a smooth and proficient cycle for your monetary exchanges.

Moving cash from your Facebook Pay record to your Money Application is a direct interaction, however, it requires a cautious route of the two stages. Here’s a detailed guide to ensure a smooth transfer:

Seamless Process: Transferring money between Facebook Pay and Cash App is designed to be seamless, minimizing the steps involved.

Instantaneous Transactions: In most cases, transfers are processed instantly, allowing recipients to access the funds without delay.

Unified Transaction History: Both platforms usually provide a consolidated transaction history, making it easy to track and manage your financial activity.

Benefits of Transferring Money:

Potential Drawbacks:

Step 1: Linking Facebook Pay and Cash App accounts

Step 2: Initiating a transfer

Step 3: Confirming the transfer

Step 4: Receiving funds in the receiving account

By following these viable advances, you can effectively move cash from your Facebook Pay record to your Money Application, exploiting the accommodation and proficiency of these famous shared installment stages.

Note: While the cycle is by and large smooth, it’s vital to remain informed about any updates or changes in the functionalities of both Facebook Pay and Money Application to guarantee a problem-free encounter.

Even with the streamlined processes of Facebook Pay and Cash App, users may encounter occasional challenges. Understanding potential issues and having troubleshooting tips at your disposal can ensure a smooth financial experience. Let’s explore some common concerns and ways to address them:

Transaction Delays:

Incorrect Recipient Details:

Account Linking Issues:

Transaction Reversals:

Security Concerns:

Keep Apps Updated:

Review Transaction History:

Contact Customer Support:

Stay Informed:

By remaining proactive and resolving potential issues speedily, you can partake in a problem-free encounter while moving cash between Facebook Pay and Cash App. Remember that both platforms prioritize user security and aim to provide reliable financial services.

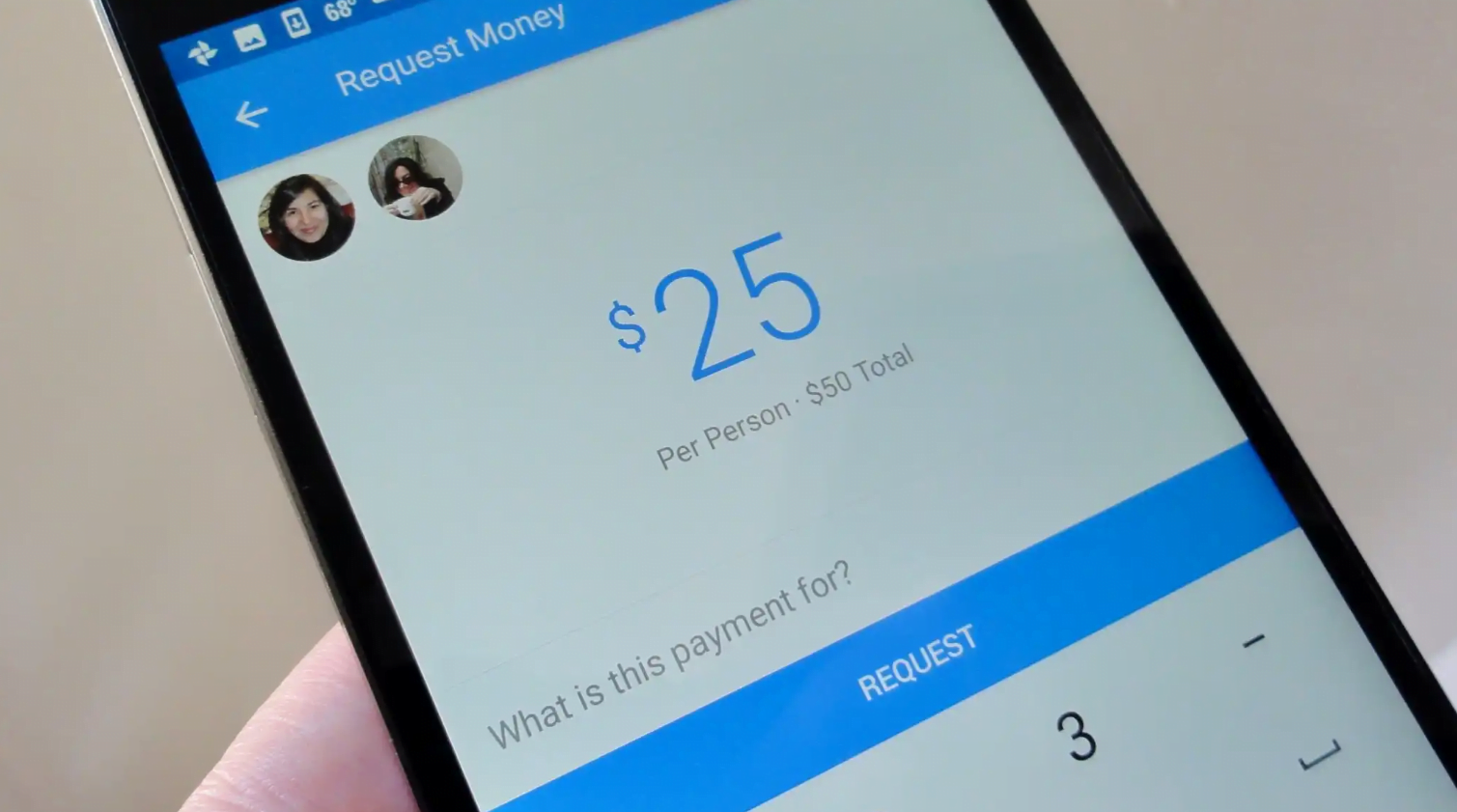

Requesting money on Facebook Pay is a convenient feature that streamlines the process of settling debts or sharing expenses. Here is a step-by-step guide on the most proficient method to demand cash from your contacts:

Guide to Requesting Funds

Access Messenger or Payments:

Select Contact:

Tap on Request:

Specify Amount:

Add Note (Optional):

Choose Payment Method:

Send Request:

Confirmation

If you have any desire to involve Facebook Pay on Courier for consistent cash moves, guarantee that you have set up Facebook Pay and connected the important installment strategies. Here is a short aide:

Open Messenger:

Initiate a Chat:

Tap on the Dollar Sign:

Choose Send Money or Request:

Follow the Steps:

By using the request money feature on Facebook Pay and Cash App, you can efficiently manage financial exchanges with friends and contacts, creating a transparent and straightforward process for settling debts or sharing expenses.

Note: Ensure that your contacts are also using Facebook Pay to facilitate smooth transactions. If they haven’t set it up, they’ll receive prompts to do so when you send a request.

Linking your Facebook Pay and Cash App opens up a world of possibilities for seamless money transfers and financial management. Here’s a detailed guide on how to link these two platforms:

Steps for Integration

Step 1: Download the Cash App

If you haven’t as of now, download and introduce the Money Application on your cell phone. Adhere to the application’s arrangement guidelines to make a record.

Stage 2: Interface Your Check Card

During the Money Application arrangement, you’ll be provoked to connect your charge card to your record. Adhere to the on-screen guidelines to interface your card safely.

Stage 3: Empower Money Application Direct Store

While discretionary, empowering direct store. In real money Applications can give extra functionalities, for example, getting checks straightforwardly into your Money Application account.

Step 4: Link Your Cash App Account in Facebook Pay Settings

Now, let’s establish the link between your Facebook Pay and Cash App:

Open Facebook Pay Settings:

Find Link External Accounts:

Choose Cash App:

Follow the Prompts:

Verify the Link:

Seamless Money Transfers:

Convenience and Ease of Use:

Takes Advantage of Existing Apps:

Potential Drawbacks

Security Concerns:

Transaction Fees:

Technical Issues:

Note: Routinely check for refreshes on both the Money Application and Facebook Pay and Cash App to guarantee similarity and admittance to the most recent highlights.

Connecting your Money Application to Facebook Pay and Cash App can offer a scope of benefits, upgrading your monetary experience. However, it’s essential to be aware of potential drawbacks to make informed decisions. Let’s explore the benefits and potential concerns associated with integrating these two platforms:

Seamless Money Transfers:

Linking your Facebook Pay and Cash App streamlines the process of transferring funds between the two platforms. This integration eliminates the need for manual transactions, making it convenient for users who frequently engage in financial exchanges.

Convenience and Ease of Use:

Managing your financial activities from a central point becomes more convenient when the Facebook Pay and Cash App. This unified approach allows for efficient tracking of transactions and balances, reducing the need to switch between apps for different purposes.

Takes Advantage of Existing Apps:

By linking Facebook Pay and Cash App, users can leverage the unique features and functionalities of both platforms. This integration enhances the overall financial ecosystem, providing a comprehensive solution for various money-related activities.

Security Concerns:

The primary concern when linking accounts is the security of your financial information. It’s crucial to prioritize security measures, such as regularly updating passwords and enabling two-factor authentication on both Facebook Pay and Cash App. Stay vigilant to protect your accounts from unauthorized access.

Transaction Fees:

While many peer-to-peer transactions are fee-free, it’s essential to be aware of any associated fees when transferring money between Facebook Pay and Cash App. Familiarize yourself with the fee structures of both platforms to avoid unexpected charges.

Technical Issues:

Technology is not infallible, and users may encounter technical issues when linking accounts or conducting transactions. Stay informed about any updates or known issues with both Facebook Pay and Cash App to troubleshoot potential challenges promptly.

Security should always be a top priority when dealing with financial transactions. Here are some key security practices to follow:

Regularly Update Passwords:

Enable Two-Factor Authentication:

Monitor Account Activity:

Secure Your Devices:

By understanding the benefits and potential drawbacks of linking Facebook Pay and Cash App, users can make informed decisions based on their preferences and priorities. This integration has the potential to significantly enhance the efficiency of financial transactions while requiring careful consideration of security and fee-related aspects.

As you navigate the world of digital finance, it’s valuable to explore alternative peer-to-peer payment platforms that offer distinct features and functionalities. Here, we’ll delve into two popular options: Zelle Payments and a general understanding of peer-to-peer (P2P) payments.

Zelle is a widely used peer-to-peer payment service that facilitates quick and secure money transfers between users. Here’s a brief look at its key features:

Instant Transfers:

Bank Integration:

Wide Accessibility:

Email or Phone Number Transactions:

Peer-to-peer payments, in a broader sense, involve the exchange of funds directly between individuals without the need for traditional banking intermediaries. Here are some general insights into P2P payments:

Convenience and Speed:

Diverse Platforms:

Mobile App Integration:

Security Measures:

If someone has initiated a payment to you through Facebook Pay and Cash App, the process for receiving money is straightforward:

Notification:

Confirmation:

Deposit to Bank Account:

Sending money through Zelle is a simple process, often integrated into your bank’s mobile app:

Access Mobile Banking App:

Select Recipient:

Specify Amount:

Confirm and Send:

For users seeking integration between Facebook Pay and Cash App, here’s a comprehensive guide on how to link these two platforms. The process involves downloading the Cash App, connecting your debit card, enabling direct deposit, and linking your Cash App account in Facebook Pay settings.

Seamless Money Transfers:

Convenience and Ease of Use:

Takes Advantage of Existing Apps:

Security Concerns:

Transaction Fees:

Technical Issues:

By exploring alternative peer-to-peer payment platforms and understanding the intricacies of receiving money on Facebook Pay and Cash App and sending money through Zelle, users can make informed choices based on their specific needs and preferences. Whether opting for the convenience of established platforms or exploring emerging services, the digital finance landscape offers a variety of options for seamless money management.

Navigating the world of digital finance and peer-to-peer payments involves understanding the intricacies of linking accounts, exploring alternative platforms, and prioritizing security. Whether seamlessly transferring funds between Facebook Pay and Cash App, requesting money within the Facebook ecosystem, or exploring the features of platforms like Zelle, users have an array of options at their disposal.

The benefits of linking Facebook Pay and Cash App include streamlined transactions and a unified financial experience, but it’s essential to be mindful of security considerations and potential fees. As the landscape of digital payments continues to evolve, staying informed about updates, best practices, and emerging platforms ensures a smooth and secure financial journey.

Whether opting for established services or exploring new avenues, users can make the most of the digital finance ecosystem for convenient and efficient money management.

Please Enter Your Message