Introduction

Welcome to a comprehensive guide on easily transferring money between Facebook Pay and Cash App. In a time where advanced exchanges are overcome, connecting these two well-known stages can offer unmatched accommodation.

This article will walk you through the arrangement cycle, guide you on moving assets easily, and give important experiences into likely advantages and disadvantages. Whether you’re a carefully prepared client or new to distributed installments, this guide guarantees a smooth excursion from starting exchanges to investigating issues.

Let’s jump into the universe of easy cash moves and open the maximum capacity of the Facebook Pay and Cash App to Money application.

Setting Up and Connecting Accounts

Setting up Facebook Pay

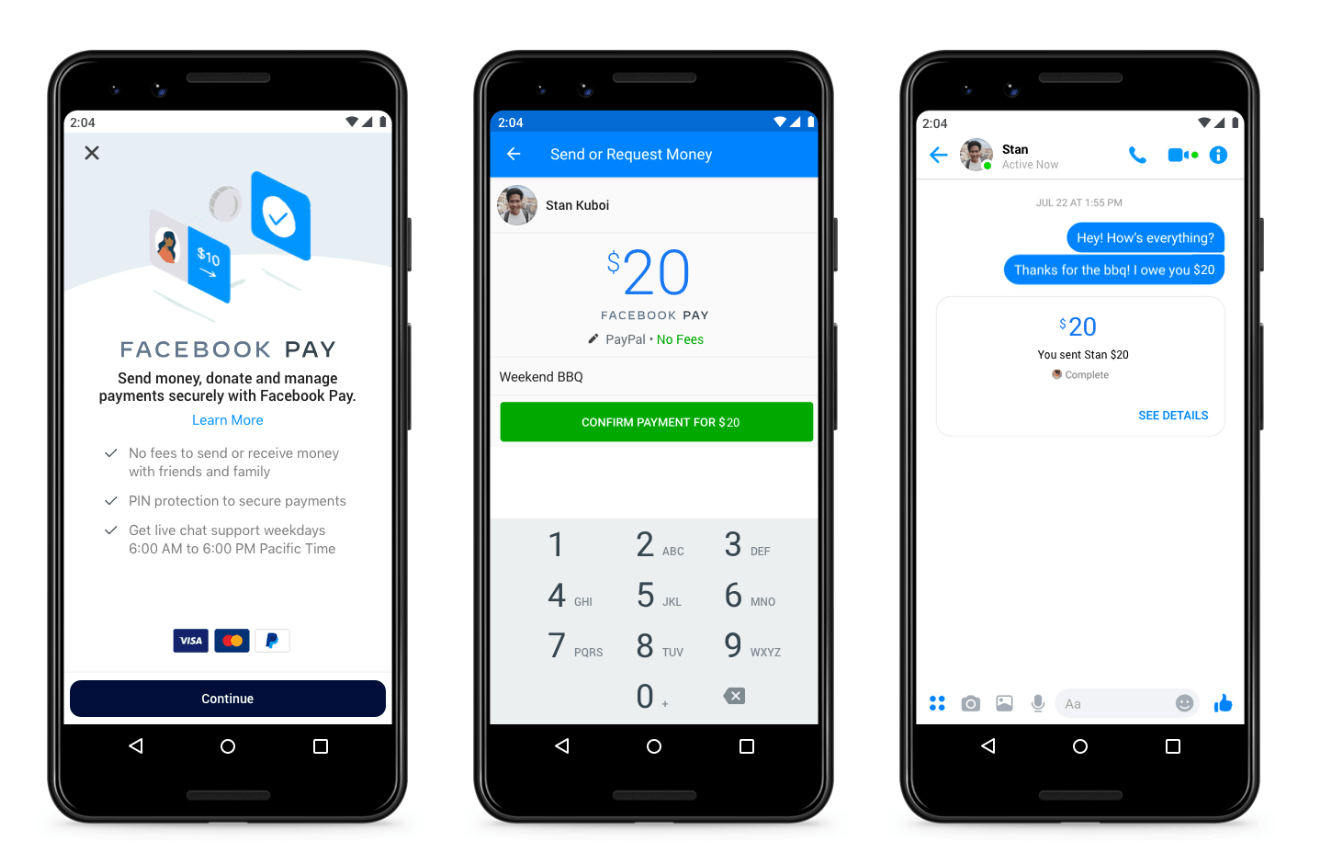

Facebook Pay is the most common way of sending and getting cash inside the Facebook biological system. To get everything rolling, follow these steps:

1. Navigate to Facebook Pay: Open your Facebook application and go to the Settings menu Look for “Facebook Pay” or a similar option.

2. Initiate Setup: Follow the on-screen instructions to set up your Facebook Pay account. You may need to enter your payment details and personal information.

3. Review and Confirm: Carefully review the information you’ve entered and confirm your setup. This step ensures the accuracy of your linked payment methods.

Adding a Bank Account to Facebook Pay

Connecting your financial balance to Facebook Pay is critical for consistent exchanges. This is the way you can make it happen:

1. Access Facebook Pay Settings: Go back to the Facebook Pay section in your app’s Settings.

2. Add Payment Method: Search for the choice to add an installment strategy and pick “Financial balance.”

3. Enter Bank Details: Info your financial balance subtleties, including the record and direct numbers.

4. Verification Process: Facebook may conduct a verification process to ensure the authenticity of the linked bank account. This could involve a small test deposit that you’ll need to confirm.

Connecting Facebook Pay and Cash App

Now that your Facebook Pay is set up, how about we associate it with your Money Application for consistent cash moves:

1. Download Money Application: On the off chance that you haven’t as of now, download and introduce the Money Application on your cell phone.

2. Connect Charge Card: Open the Money Application and connect your check card to your record. This is usually done during the initial setup process.

3. Enable Direct Deposit (Optional): While not mandatory, enabling direct deposit in the Cash App can provide added functionality for receiving funds.

4. Link Cash App in Facebook Pay Settings: Return to Facebook Pay settings and look for the option to link external accounts. Choose Cash App and follow the prompts to establish the connection.

By finishing these means, you’ve effectively set up and associated your Facebook Pay and Money Application accounts. This establishes the groundwork for smooth and secure cash moves between the two stages. In the following segments, we’ll investigate how to add reserves, start moves, and address any potential difficulties that might occur.

Adding Funds to Facebook Pay

When your Facebook Pay account is set up and associated with your Money Application, the subsequent stage is to add assets to work with consistent exchanges. Here is a step-by-step guide:

Access Facebook Pay Balance:

-

- Open the Facebook app and navigate to the Facebook Pay section in Settings.

- Look for the option related to your Facebook Pay balance.

Add Funds:

-

- Select the option to add funds to your balance.

- Choose your preferred payment method, which could include your linked bank account or debit card.

Specify Amount:

-

- Enter the amount you want to add to your Facebook Pay balance.

- Review the transaction details to ensure accuracy.

Confirm Transaction:

-

- Confirm the transaction, and if necessary, complete any additional security checks.

Verification Process:

-

- Facebook may conduct a verification process to ensure the legitimacy of the transaction.

- This could involve confirming the transaction via email, text, or app notification.

By following these means, you’ll have effectively financed your Facebook Pay balance, making a pool of assets that can be handily used for different exchanges inside the Facebook biological system.

Note: It’s fundamental to keep an adequate equilibrium in your Facebook Pay record to start moves to Money Application.

In the following segment, we’ll investigate the different techniques and steps engaged in moving cash from your Facebook Pay equilibrium to your Money Application account, guaranteeing a smooth and proficient cycle for your monetary exchanges.

Moving Cash from Facebook Pay to Money Application

Moving cash from your Facebook Pay record to your Money Application is a direct interaction, however, it requires a cautious route of the two stages. Here’s a detailed guide to ensure a smooth transfer:

Methods of Transferring Money

In-App Transfer:

- Open the Facebook app and navigate to the Messenger or Payments section.

- Choose the contact or recipient to whom you want to send money.

- Select the amount and payment method (your Facebook Pay balance).

Linking Accounts:

- In Cash App, access the settings menu and locate the option to link external accounts.

- Confirm that your Facebook Pay account is successfully linked.

Benefits of Transferring Money

Seamless Process: Transferring money between Facebook Pay and Cash App is designed to be seamless, minimizing the steps involved.

Instantaneous Transactions: In most cases, transfers are processed instantly, allowing recipients to access the funds without delay.

Unified Transaction History: Both platforms usually provide a consolidated transaction history, making it easy to track and manage your financial activity.

Advantages and Disadvantages

Benefits of Transferring Money:

- Utilize existing funds in your Facebook Pay balance.

- Leverage the convenience of both platforms for various financial transactions.

Potential Drawbacks:

- Ensure that both platforms are compatible to avoid technical issues.

- Be mindful of any transaction fees associated with transferring funds between the two services.

Practical Steps

Step 1: Linking Facebook Pay and Cash App accounts

- Confirm that your Facebook Pay and Cash App accounts are properly linked to enable seamless transfers.

Step 2: Initiating a transfer

- In the Facebook app, initiate a transfer by selecting the recipient and specifying the amount.

Step 3: Confirming the transfer

- Confirm the transfer details, ensuring the accuracy of the recipient and the selected payment method.

Step 4: Receiving funds in the receiving account

- The recipient, having linked their Cash App account, should receive the funds instantly.

By following these viable advances, you can effectively move cash from your Facebook Pay record to your Money Application, exploiting the accommodation and proficiency of these famous shared installment stages.

Note: While the cycle is by and large smooth, it’s vital to remain informed about any updates or changes in the functionalities of both Facebook Pay and Money Application to guarantee a problem-free encounter.

Troubleshooting and Potential Issues

Even with the streamlined processes of Facebook Pay and Cash App, users may encounter occasional challenges. Understanding potential issues and having troubleshooting tips at your disposal can ensure a smooth financial experience. Let’s explore some common concerns and ways to address them:

Identifying and Resolving Problems

Transaction Delays:

-

- Issue: Funds not reflected in the recipient’s Cash App account immediately.

- Solution: Give it some time, as delays may occur due to network issues. If the problem persists, check your transaction history for any error messages.

Incorrect Recipient Details:

-

- Issue: Accidentally sending money to the wrong Cash App account.

- Solution: Double-check recipient details before confirming transactions. If sent to the wrong account, contact Cash App support promptly.

Account Linking Issues:

-

- Issue: Difficulty linking your Cash App account to Facebook Pay.

- Solution: Verify that both apps are updated. Reattempt the linking process, ensuring accurate login credentials.

Transaction Reversals:

-

- Issue: Accidental transfers or unauthorized transactions.

- Solution: Reach out to both Facebook Pay and Cash App support immediately to report the issue. They can guide you through the process of reversing transactions, if possible.

Security Concerns:

-

- Issue: Worries about the security of financial information.

- Solution: Regularly update passwords, enable two-factor authentication, and review privacy settings in both Facebook Pay and Cash App.

Tips for a Smooth Experience

Keep Apps Updated:

-

- Regularly update both Facebook and Cash App to access the latest features and security enhancements.

Review Transaction History:

-

- Periodically review your transaction history on both platforms to identify and address any discrepancies.

Contact Customer Support:

-

- If encounter persistent issues, don’t hesitate to reach out to the customer support teams of both Facebook Pay and Cash App.

Stay Informed:

-

- Be aware of any policy changes or updates from both platforms that may affect the functionality of the money transfer process.

By remaining proactive and resolving potential issues speedily, you can partake in a problem-free encounter while moving cash between Facebook Pay and Cash App. Remember that both platforms prioritize user security and aim to provide reliable financial services.

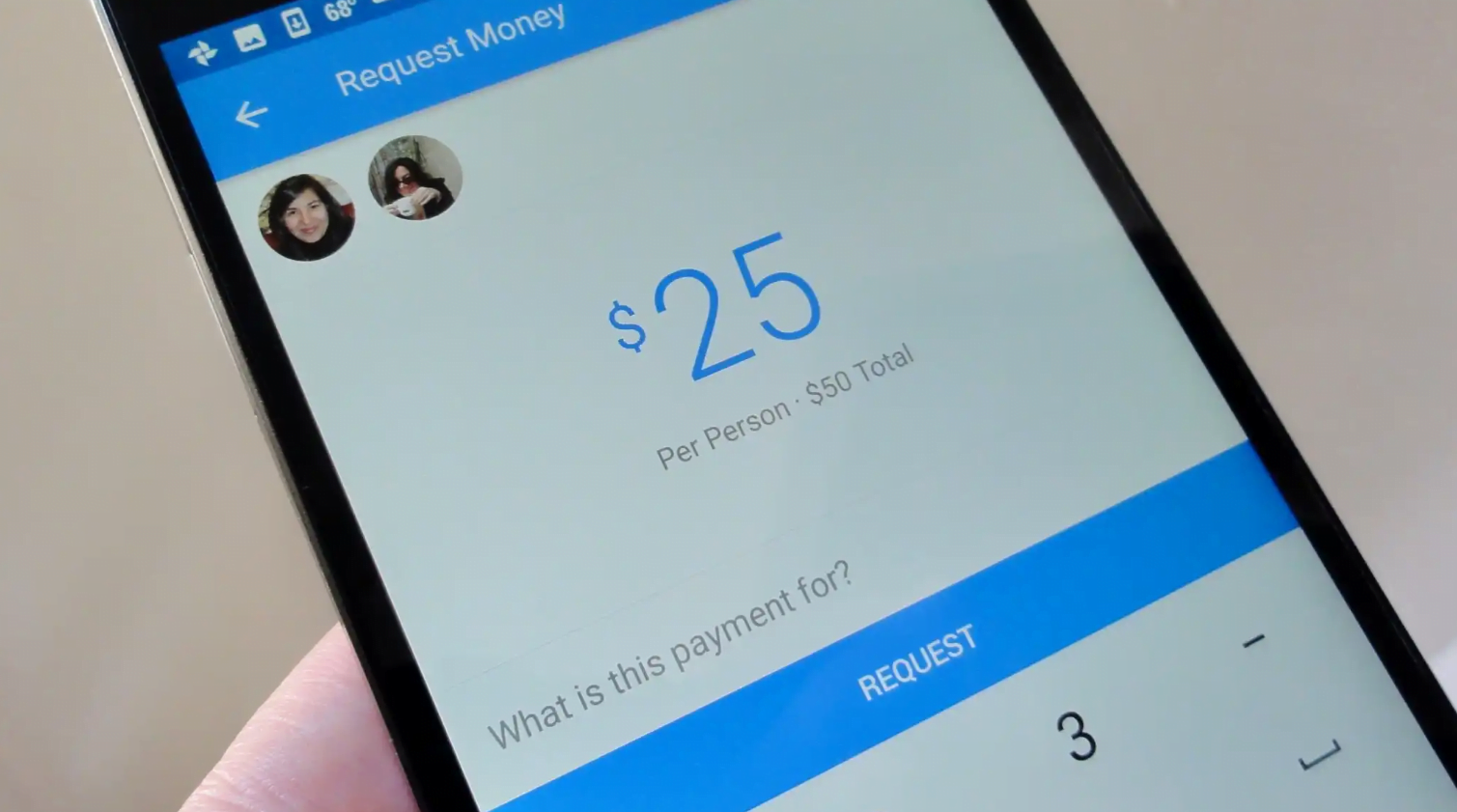

Requesting Money on Facebook Pay

Requesting money on Facebook Pay is a convenient feature that streamlines the process of settling debts or sharing expenses. Here is a step-by-step guide on the most proficient method to demand cash from your contacts:

Guide to Requesting Funds

Access Messenger or Payments:

-

- Open the Facebook app and navigate to either the Messenger or Payments section.

Select Contact:

-

- Choose the friend or contact from whom you want to request money.

Tap on Request:

-

- Look for the option to request money and tap on it.

Specify Amount:

-

- Enter the amount you want to request.

Add Note (Optional):

-

- Include a note to provide context for the request. This could be a brief description of the reason for the request.

Choose Payment Method:

-

- Select the payment method through which you want to receive the funds. This can be your linked bank account or another preferred method.

Send Request:

-

- Confirm the details and send the request. Your contact will receive a notification prompting them to fulfill the request.

Confirmation

-

- Once your contact fulfills the request, you’ll receive a confirmation, and the funds will be added to your Facebook Pay balance.

How to Get Facebook Pay on Messenger

If you have any desire to involve Facebook Pay on Courier for consistent cash moves, guarantee that you have set up Facebook Pay and connected the important installment strategies. Here is a short aide:

Open Messenger:

-

- Access the Messenger app on your device.

Initiate a Chat:

-

- Start a conversation with the contact to whom you want to send money or request funds.

Tap on the Dollar Sign:

-

- Look for the dollar sign icon in the chat window, indicating the payments feature.

Choose Send Money or Request:

-

- Select either “Send Money” or “Request” based on your intent.

Follow the Steps:

-

- The app will guide you through the steps to complete the transaction.

By using the request money feature on Facebook Pay and Cash App, you can efficiently manage financial exchanges with friends and contacts, creating a transparent and straightforward process for settling debts or sharing expenses.

Note: Ensure that your contacts are also using Facebook Pay to facilitate smooth transactions. If they haven’t set it up, they’ll receive prompts to do so when you send a request.

Linking Cash App to Facebook Pay

Linking your Facebook Pay and Cash App opens up a world of possibilities for seamless money transfers and financial management. Here’s a detailed guide on how to link these two platforms:

Steps for Integration

Step 1: Download the Cash App

If you haven’t as of now, download and introduce the Money Application on your cell phone. Adhere to the application’s arrangement guidelines to make a record.

Stage 2: Interface Your Check Card

During the Money Application arrangement, you’ll be provoked to connect your charge card to your record. Adhere to the on-screen guidelines to interface your card safely.

Stage 3: Empower Money Application Direct Store

While discretionary, empowering direct store. In real money Applications can give extra functionalities, for example, getting checks straightforwardly into your Money Application account.

Step 4: Link Your Cash App Account in Facebook Pay Settings

Now, let’s establish the link between your Facebook Pay and Cash App:

Open Facebook Pay Settings:

-

- Access the Facebook app on your device and navigate to the Facebook Pay section in Settings.

Find Link External Accounts:

-

- Look for the option to link external accounts within Facebook Pay settings.

Choose Cash App:

-

- Select Cash App from the list of supported external accounts.

Follow the Prompts:

-

- Facebook will guide you through the process of linking your Cash App. This may involve logging into your Cash App account to authorize the connection.

Verify the Link:

-

- Once linked, verify the connection by checking the linked accounts in both Facebook Pay and Cash App settings.

Benefits of Linking Cash App and Facebook Pay

Seamless Money Transfers:

- Easily transfer funds between your Facebook Pay and Cash App without the need for manual transactions.

Convenience and Ease of Use:

- Streamline your financial activities by managing both platforms from a central point.

Takes Advantage of Existing Apps:

- Leverage the features of both Facebook Pay and Cash App for a comprehensive financial experience.

Potential Drawbacks

Security Concerns:

- Be mindful of the security of your linked accounts. Regularly update passwords and enable two-factor authentication.

Transaction Fees:

- Understand any potential fees associated with transferring money between Facebook Pay and Cash App. Familiarize yourself with the fee structures of both platforms.

Technical Issues:

- Stay informed about any technical updates or issues that may impact the seamless integration of Facebook Pay and Cash App. By connecting your Money Application to Facebook Pay and Cash App, you’re making a strong monetary biological system that joins the qualities of the two stages. This reconciliation improves the effectiveness of your exchanges and gives a bound together way to deal with dealing with your funds.

Note: Routinely check for refreshes on both the Money Application and Facebook Pay and Cash App to guarantee similarity and admittance to the most recent highlights.

Advantages and Disadvantages of Connecting Records

Connecting your Money Application to Facebook Pay and Cash App can offer a scope of benefits, upgrading your monetary experience. However, it’s essential to be aware of potential drawbacks to make informed decisions. Let’s explore the benefits and potential concerns associated with integrating these two platforms:

Advantages of Linking

Seamless Money Transfers:

Linking your Facebook Pay and Cash App streamlines the process of transferring funds between the two platforms. This integration eliminates the need for manual transactions, making it convenient for users who frequently engage in financial exchanges.

Convenience and Ease of Use:

Managing your financial activities from a central point becomes more convenient when the Facebook Pay and Cash App. This unified approach allows for efficient tracking of transactions and balances, reducing the need to switch between apps for different purposes.

Takes Advantage of Existing Apps:

By linking Facebook Pay and Cash App, users can leverage the unique features and functionalities of both platforms. This integration enhances the overall financial ecosystem, providing a comprehensive solution for various money-related activities.

Potential Drawbacks

Security Concerns:

The primary concern when linking accounts is the security of your financial information. It’s crucial to prioritize security measures, such as regularly updating passwords and enabling two-factor authentication on both Facebook Pay and Cash App. Stay vigilant to protect your accounts from unauthorized access.

Transaction Fees:

While many peer-to-peer transactions are fee-free, it’s essential to be aware of any associated fees when transferring money between Facebook Pay and Cash App. Familiarize yourself with the fee structures of both platforms to avoid unexpected charges.

Technical Issues:

Technology is not infallible, and users may encounter technical issues when linking accounts or conducting transactions. Stay informed about any updates or known issues with both Facebook Pay and Cash App to troubleshoot potential challenges promptly.

Security Concerns

Security should always be a top priority when dealing with financial transactions. Here are some key security practices to follow:

Regularly Update Passwords:

-

- Change your passwords regularly and avoid using easily guessable combinations.

Enable Two-Factor Authentication:

-

- Add an extra layer of security by enabling two-factor authentication on both Facebook Pay and Cash App.

Monitor Account Activity:

-

- Regularly review your transaction history to identify any unauthorized or suspicious activities.

Secure Your Devices:

-

- Ensure that the devices you use for financial transactions are secure. Use passcodes or biometric authentication to access your devices.

By understanding the benefits and potential drawbacks of linking Facebook Pay and Cash App, users can make informed decisions based on their preferences and priorities. This integration has the potential to significantly enhance the efficiency of financial transactions while requiring careful consideration of security and fee-related aspects.

Exploring Other Peer-to-Peer Payment Platforms

As you navigate the world of digital finance, it’s valuable to explore alternative peer-to-peer payment platforms that offer distinct features and functionalities. Here, we’ll delve into two popular options: Zelle Payments and a general understanding of peer-to-peer (P2P) payments.

Overview of Zelle Payments

Zelle is a widely used peer-to-peer payment service that facilitates quick and secure money transfers between users. Here’s a brief look at its key features:

Instant Transfers:

-

- Zelle enables near-instantaneous transfers between users, making it an efficient option for quick transactions.

Bank Integration:

-

- Linked directly to bank accounts, Zelle eliminates the need for additional intermediaries, providing a seamless and direct transfer process.

Wide Accessibility:

-

- Many major banks in the United States have integrated Zelle into their mobile banking apps, enhancing accessibility for users.

Email or Phone Number Transactions:

-

- Zelle transactions are often initiated using the recipient’s email address or phone number, simplifying the payment process.

Understanding P2P Payments

Peer-to-peer payments, in a broader sense, involve the exchange of funds directly between individuals without the need for traditional banking intermediaries. Here are some general insights into P2P payments:

Convenience and Speed:

-

- P2P payments offer the convenience of transferring money quickly and efficiently, often in real-time.

Diverse Platforms:

-

- Various platforms provide P2P payment services, catering to different preferences and needs. Apart from Zelle, notable examples include Venmo, PayPal, and Google Pay.

Mobile App Integration:

-

- P2P payments are commonly integrated into mobile banking apps, allowing users to manage their finances seamlessly.

Security Measures:

-

- Reputable P2P payment platforms prioritize security, implementing measures such as encryption and authentication to safeguard user information.

How Do You Receive Money on Facebook Pay?

If someone has initiated a payment to you through Facebook Pay and Cash App, the process for receiving money is straightforward:

Notification:

-

- You will receive a notification, either in your Facebook app or through Messenger, indicating that you’ve been sent money.

Confirmation:

-

- Confirm the transaction details and ensure they match your expectations.

Deposit to Bank Account:

-

- The received funds can be deposited directly into your linked bank account through Facebook Pay and Cash App.

How Do You Send Money Through Zelle?

Sending money through Zelle is a simple process, often integrated into your bank’s mobile app:

Access Mobile Banking App:

-

- Open your bank’s mobile app and navigate to the section that offers Zelle services.

Select Recipient:

-

- Choose the recipient from your contacts by entering their email address or phone number.

Specify Amount:

-

- Enter the amount you want to send and review the transaction details.

Confirm and Send:

-

- Confirm the transaction and the recipient will receive the funds almost instantly.

Can You Link Cash App to Facebook Pay? A Detailed Guide

For users seeking integration between Facebook Pay and Cash App, here’s a comprehensive guide on how to link these two platforms. The process involves downloading the Cash App, connecting your debit card, enabling direct deposit, and linking your Cash App account in Facebook Pay settings.

Benefits of Linking Cash App and Facebook Pay

Seamless Money Transfers:

-

- Integration between Facebook Pay and Cash App streamlines the process of transferring funds, enhancing user convenience.

Convenience and Ease of Use:

-

- Managing financial activities becomes more convenient with a unified approach, reducing the need to switch between apps.

Takes Advantage of Existing Apps:

-

- Users can leverage the unique features of both Facebook Pay and Cash App, creating a comprehensive financial ecosystem.

Potential Drawbacks to Linking

Security Concerns:

-

- Users should prioritize security measures, including regular password updates and enabling two-factor authentication.

Transaction Fees:

-

- Be aware of any associated fees when transferring money between Facebook Pay and Cash App, understanding the fee structures of both platforms.

Technical Issues:

-

- Stay informed about updates and known issues to troubleshoot potential challenges promptly.

By exploring alternative peer-to-peer payment platforms and understanding the intricacies of receiving money on Facebook Pay and Cash App and sending money through Zelle, users can make informed choices based on their specific needs and preferences. Whether opting for the convenience of established platforms or exploring emerging services, the digital finance landscape offers a variety of options for seamless money management.

Conclusion

Navigating the world of digital finance and peer-to-peer payments involves understanding the intricacies of linking accounts, exploring alternative platforms, and prioritizing security. Whether seamlessly transferring funds between Facebook Pay and Cash App, requesting money within the Facebook ecosystem, or exploring the features of platforms like Zelle, users have an array of options at their disposal.

The benefits of linking Facebook Pay and Cash App include streamlined transactions and a unified financial experience, but it’s essential to be mindful of security considerations and potential fees. As the landscape of digital payments continues to evolve, staying informed about updates, best practices, and emerging platforms ensures a smooth and secure financial journey.

Whether opting for established services or exploring new avenues, users can make the most of the digital finance ecosystem for convenient and efficient money management.

One thought on “4 Best Steps For Connecting Facebook Pay and Cash App”