In the fast-paced world of digital finance, the allure of quick profits can often blind even seasoned investors to the dangers of Forex Scams. As we move through 2026, scammers have become more sophisticated, using “ghost” platforms—websites that look like professional brokerages but have no connection to the actual market.

Foreign exchange fraud is a growing global threat, but these ghost platforms usually leave a trail of breadcrumbs. By understanding their anatomy, you can protect your capital before it vanishes.

1. The “Guaranteed Profit” Mirage

The most immediate red flag of Forex Scams is the promise of consistent, risk-free returns. In a legitimate, volatile market, no one can guarantee profit. Ghost brokers often use AI-generated “success stories” or deepfake videos of celebrities to convince you that their “secret algorithm” eliminates risk.

The Reality: If a platform claims you can earn “10% daily with zero risk,” it’s not a broker; it’s a trap.

2. Phantom Regulations & Clone Licenses

Scammers know you’ve been told to check for a license. To counter this, they use “Clone Firms”—illegal entities that steal the registration number and address of a real, authorised broker. They might even create a fake “Regulatory Authority” website to “verify” their own status.

- The Test: Always verify a broker’s license directly on the regulator’s official website (such as the FCA, ASIC, or CFTC), rather than clicking a link provided by the broker.

3. The “Virtual Reality” Dashboard

Many ghost platforms use sophisticated “MetaTrader” clones or custom-built dashboards that show you making massive “profits.” These numbers are entirely fictional. The platform is not connected to any liquidity provider; it is simply a video game designed to make you feel like a winner so that you deposit more money.

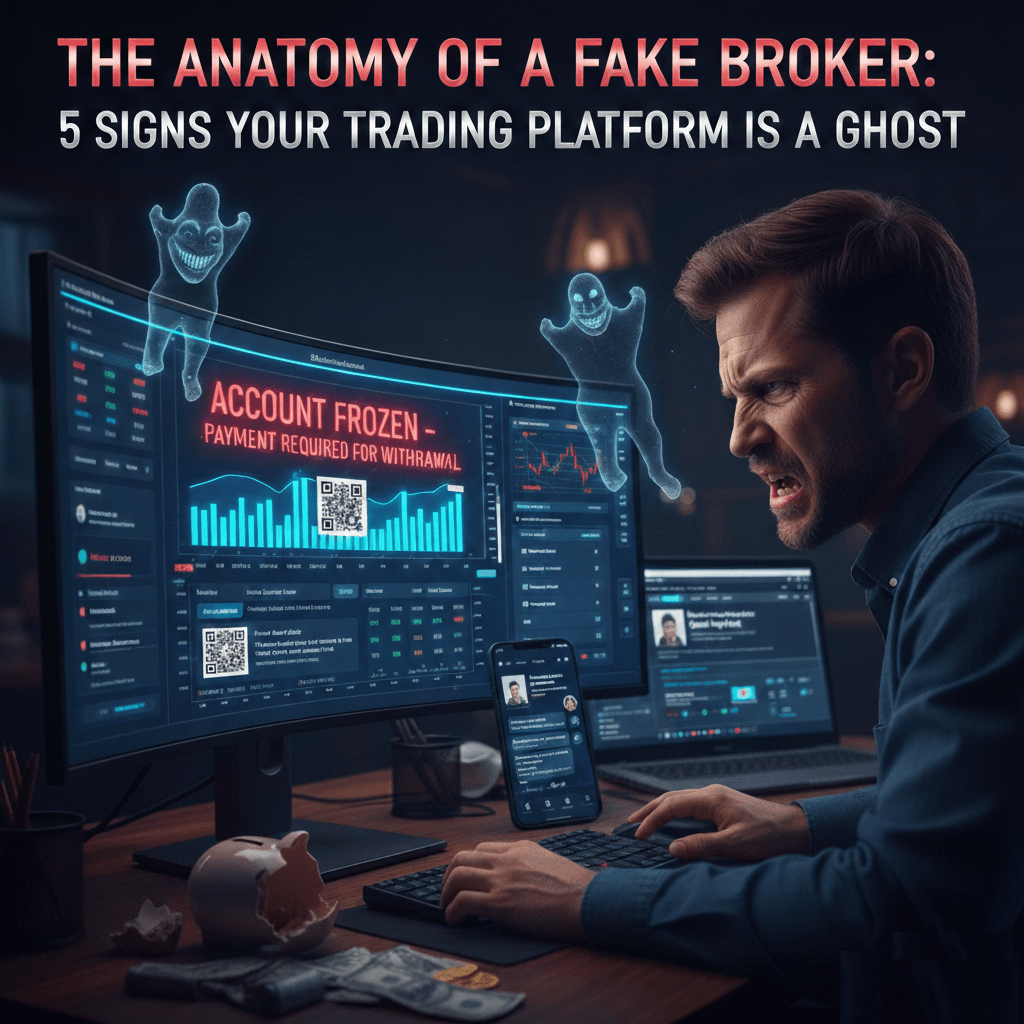

4. The Withdrawal Wall

A ghost broker is happy to take your money, but they will never let it leave. When you attempt a withdrawal, the “Ghost” suddenly becomes a “Gatekeeper.” You may be told you need to pay:

- “Withholding taxes” upfront.

- “Activation fees” to unlock your account.

- “Laundering verification” deposits. Legitimate brokers deduct fees from your existing balance; they never ask for more money to send you your own money.

5. High-Pressure “Account Managers”

Unlike real brokers who provide technical support, ghost platforms assign you an “Account Manager” (often via WhatsApp or Telegram) who acts like a predatory salesperson. They will use high-pressure tactics, telling you that a “huge market move” is coming and you must invest “just $5,000 more” to capitalize on it.

What to Do If You’ve Been Targeted

If you suspect you are currently involved with a fraudulent platform, stop all communication and do not send more money. Scammers often try a “second bite” by pretending to be recovery agents who can get your money back for a fee.

For those who have already fallen victim to foreign exchange fraud, the first step toward accountability is reporting the incident. A specialized resource like Finance Complaint List (financecomplaintlist.com) provides a dedicated platform to file detailed reports against shady brokers.

By using the Finance Complaint List, you help warn other investors, create a public record of the scam, and gain access to a community and resources dedicated to exposing financial misconduct.